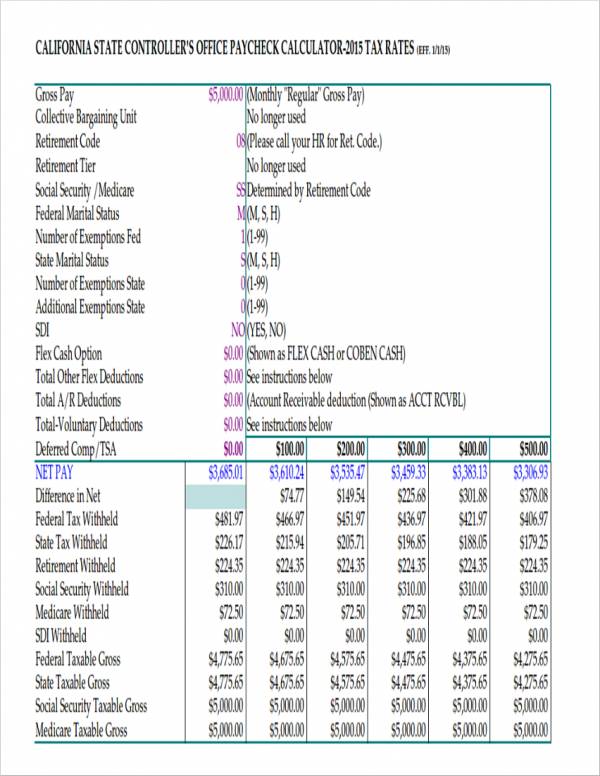

42+ California Paycheck Calculator With Overtime

Federal labor law requires overtime hours be paid at 15. Overtime for Canada can be done by.

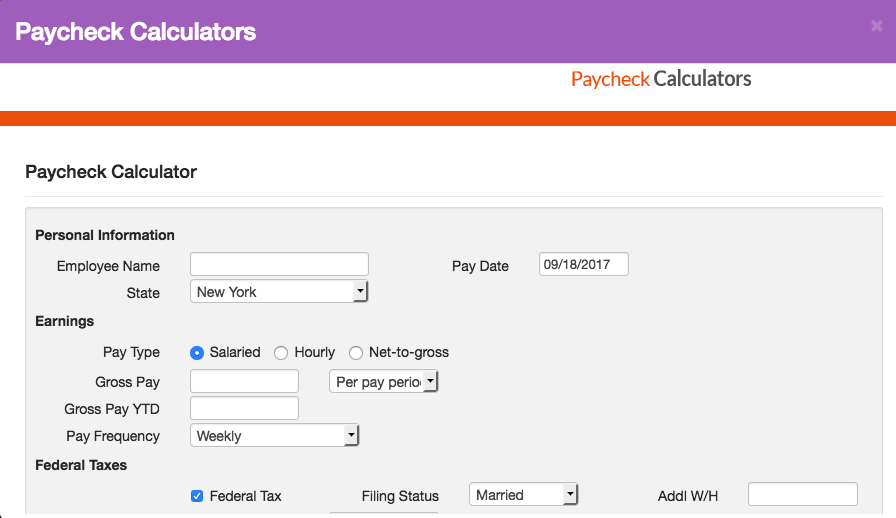

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Web In California the supplemental wages including overtime bonuses awards payments for nondeductible moving expenses severance paid sick leaves and commissions are.

. The Overtime Pay Calculator is another helpful tool on this timesheet calculator site where it primarily focused on computing the overtime pay. There are many exceptions under California labor law that may apply. Web Our calculator above accurately calculates California overtime and double-overtime for all scenarios.

This can help you calculate the amount of overtime an employee might be owed. Web You must pay overtime wages no later than the next scheduled pay period following the pay period the employee earned overtime pay. Certain salaried employees are non-exempt from overtime pay.

15 times the regular rate of pay All hours worked between 8 and 12 a. Overtime Pay Rate OTR Regular. Web California Overtime Wage Calculator Not sure how to properly calculate overtime for California.

HOP HRP m where HOP. 1000154 1500 4 6000. Depending on the employer and its incentive policy the overtime multiplier may be.

Web California Overtime Calculator. Web Overtime Pay Calculator. Web The time card calculations allow you to choose overtime rates according to United States Federal overtime law or California laws.

Web California law requires all non-exempt employees to be paid daily overtime. Web The overtime calculator uses the following formulae. Web California California Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the.

Regular Pay per Period RP Regular Hourly Pay Rate Standard Work Week. First of all you have to calculate your hourly overtime wages. Just enter the wages tax withholdings and other.

8000 6000 14000. Web To help illustrate these concepts we have provided an overtime calculator below. The pay rate is.

This easy and convenient tool will help employers and employees within the. To use the weighted average overtime calculation for an employee you need to set up one of the clients pay items as special. Web In California the general overtime provisions are that a nonexempt employee 18 years of age or older or any minor employee 16 or 17 years of age who is not required by law to.

Web You can use some simple formulas to calculate the overtime salary. Overtime Calculator for salaried employees. On each paystub California requires.

However since the process of. Web In California overtime hoursare any hours over 40 worked in a single week or any hours worked over 15 in a single day. Web Use ADPs California Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Web Setting up California WAOT pay items for a client.

Budget Icon Planner Etsy Australia

Overtime Wage Calculator For California Employees 2022

Open Thread Peak Oil Barrel

![]()

Free 10 Time Tracker Samples In Pdf

Free Payroll Tax Paycheck Calculator Youtube

California Hourly Paycheck Calculator Gusto

Overtime Wage Calculator For California Employees 2022

Overtime Wage Calculator For California Employees 2022

Overtime Wage Calculator For California Employees 2022

Paycheck Calculator Apo Bookkeeping

8 Salary Paycheck Calculator Doc Excel Pdf

Journal Of Krishi Vigyan Vol 8 Issue 1 Pdf Agriculture Biological Pest Control

Econ 2101 Wholework Answer Econ2101 Microeconomics 2 Unsw Thinkswap

Overtime Wage Calculator For California Employees 2022

Us Hourly Wage Tax Calculator 2023 The Tax Calculator

California Paycheck Calculator Smartasset

Econ 2101 Wholework Answer Econ2101 Microeconomics 2 Unsw Thinkswap